Cost of Living for Students in Vancouver

So, you’re finally starting school in Vancouver, and you’re wondering how much you’d need to actually survive.

First of all, if you’re an international student, we understand why you want to study here. For Vancouverites, you’re about to embark on a new phase of your life: you’re moving away from your childhood home.

So if you’re finally embarking on the adventure of living on your own, we did our research to show you how much the cost of living actually is for students in Vancouver.

Vancouver’s Cost of Living for Students

The cost of living in Vancouver for students is about CAD 800 to CAD 1,500 monthly. International students pay more for tuition, health insurance, and visa applications, resulting in monthly expenses of CAD 1,600 to CAD 2,700.

This price range includes a number of factors such as tuition, housing, utilities, food and groceries, transportation, entertainment, health insurance, banking, and taxes.

Factors That Affect the Cost of Living of Students in Vancouver

1. Tuition

Unless you have a scholarship, tuition is one of your greatest expenses as a student. If your parents are happy to pay your way through uni, then good for you.

But for those who are on their own, it’s important to be aware of how much they will need to budget for tuition fees.

Data from Universities Canada via https://www.univcan.ca/

Okay, before we proceed, you may have asked yourself, “Why do international students pay more tuition? We already have so many expenses!.”

Well, this is because international students are not eligible for government funding or subsidies, which means they have to pay the full cost of their education.

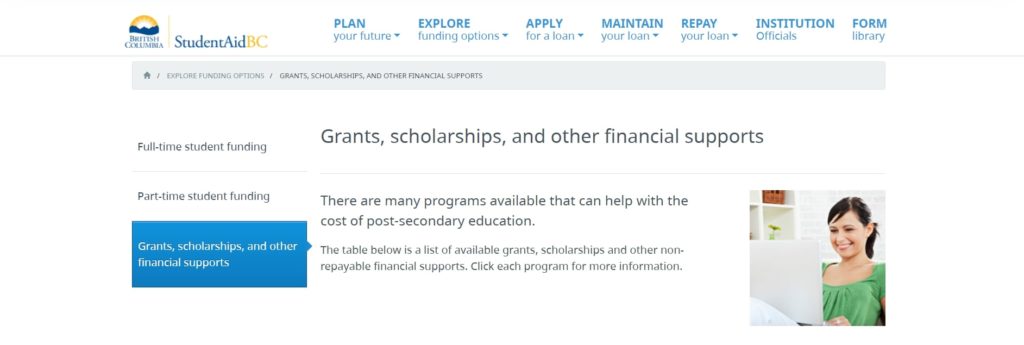

But there’s a silver lining: scholarships and financial aid. Yes, you heard that right! These are great options for students who need extra help with funding their education. It’s worth researching and applying.

The Province of British Columbia actually has a lot of grants, scholarships, and other financial support for both Canadian and international students! You can learn more about them here.

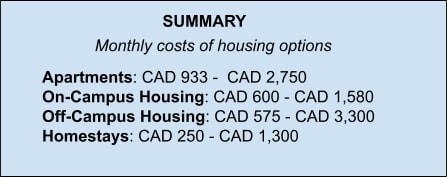

2. Housing

Next to tuition, housing is one of the most expensive things you’ll have to pay for as a student. In fact, a student living in Vancouver may spend around CAD 2,700 to CAD 3,800 per month on their living arrangements.

But don’t cry just yet! It’s not the end of the world, as getting a ridiculously expensive 2-bedroom apartment is not your only option here.

You have on-campus and off-campus student housing, and homestay, which relatively costs less than renting your own flat. Let’s take a look at your options!

1. Apartment

Okay, we want you to take a deep breath, as we all expected this section to be quite expensive. But you know why it’s pricey? You’re paying for comfort and privacy, so if you look at it that way, it kind of calms you down a bit, doesn’t it? No? Okay.

Let’s just dive into it then! We’ve compiled a list of the most favored neighbourhoods in Vancouver that are close to some of the top schools in the city and their average rent costs per month.

Data from Zumper via https://www.zumper.com/rent-research/vancouver-bc

Well, there you go. Here’s an idea! Why don’t you try and ask some of your friends that are going to the same school as you to split rent?

That way you’ll all be able to save some money and have a better chance of finding a nicer place to live in close proximity to campus.

2. On-Campus Student Housing

Ah, here we have a relatively cheaper option for ya. On-campus student housing. It’s cost-effective, you’re inside the campus, and best of all, you’re surrounded by other students, which can help you make friends.

In Vancouver, there are four major institutions that provide on-campus student housing, so let’s take a look at your options.

Oh, and remember, the cheaper option is the shared bedrooms, okay? So don’t get all shocked to see private bedroom prices.

Data from GEC Living via https://gecliving.com/

You may have noticed that the two schools don’t offer shared bedrooms. Well, it’s because they only have limited capacity for their own students, which brings us to our next housing option.

3. Off-Campus Student Housing

Off-Campus Student Housing. Personally, we think this option is the best one for students who want more independence and privacy. And you want to know the best part about it? No curfews!

Additionally, off-campus housing can often be more affordable than on-campus options, especially if you split rent with roommates. Oh, and did we mention you also get to pick your roommates?

Data from the websites of the listed universities

See? It’s not so bad. Off-campus student housing is actually a popular choice for students in Vancouver. Just make sure to lock down an apartment that’s not so far from your school.

4. Homestay

Lastly, Homestay. This option is actually wise for international students because it provides them a chance to experience the local culture and improve their language skills by living with a Canadian family.

It’s also a good environment for them to feel welcome and at home while they adjust to their new surroundings. Additionally, homestay families often provide meals and support for their students.

Basically, a full board homestay will include all meals provided by the host family, while a half board homestay will include breakfast and dinner, and a homestay with no meals means exactly that.

Data from the websites of the listed homestay companies

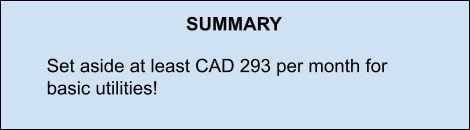

3. Utilities

Now, let’s see, let’s see. On average, you’re gonna wanna set aside a total of CAD 293 per month for basic utilities.

You know what they say: with great power comes great responsibility. Now that you have your own place, it’s your responsibility to pay for the utilities. We’re talking electricity, water, gas (if you have a car), internet, and waste disposal.

We understand if this skipped your mind because when we were all young, our parents used to take care of this for us, but now that we’re all grown up, well, we’re on our own, I guess.

Which reminds me, keep reading because we have a little tip at the end to help you pay your bills!

Data from Moving Waldo via https://www.movingwaldo.com/

This amount should cover your basic utility bills, but keep in mind that this is only an estimate so make sure to keep track of your actual bills and adjust accordingly!

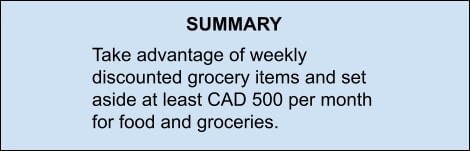

4. Food and Groceries

We’re going to give it to you straight. Set aside at least CAD 500 per month for food and groceries.

We don’t mean to sound like your mom, but we understand how tempting it is to just eat at a restaurant or order takeout, but as a student, it’s practical to buy groceries and learn how to cook your own meals.

Not sure where to go grocery shopping? Well, it’s a good thing we’ve got your back. You can find meat, vegetables, fruits, and just about anything else at these Vancouver grocery stores.

Data collected on websites of listed grocery stores

Still not convinced that grocery shopping is cost-effective? Many of these grocery stores offer weekly sales and promotions, and buying in bulk can also save you money in the long run.

Yep, you’ve read that right. Here you go! Now you have no excuse not to go grocery shopping.

- Marketplace IGA – they have weekly flyers that can save you up to 20% on discounted items such as meat, veggies, and common grocery items.

- No Frills – No Frills have weekly price cuts listed on their weekly flyers. Plus, you can also avail a PC Optimum card to earn redeemable points for future purchases.

- Safeway – Safeway might not offer price matching like the others, but they have a weekly flyer that showcases discounted items, coupons, and gift cards.

- Save on Foods – Every wednesday, Save on Foods’ weekly flyers on produce, meat, and snacks are discounted!

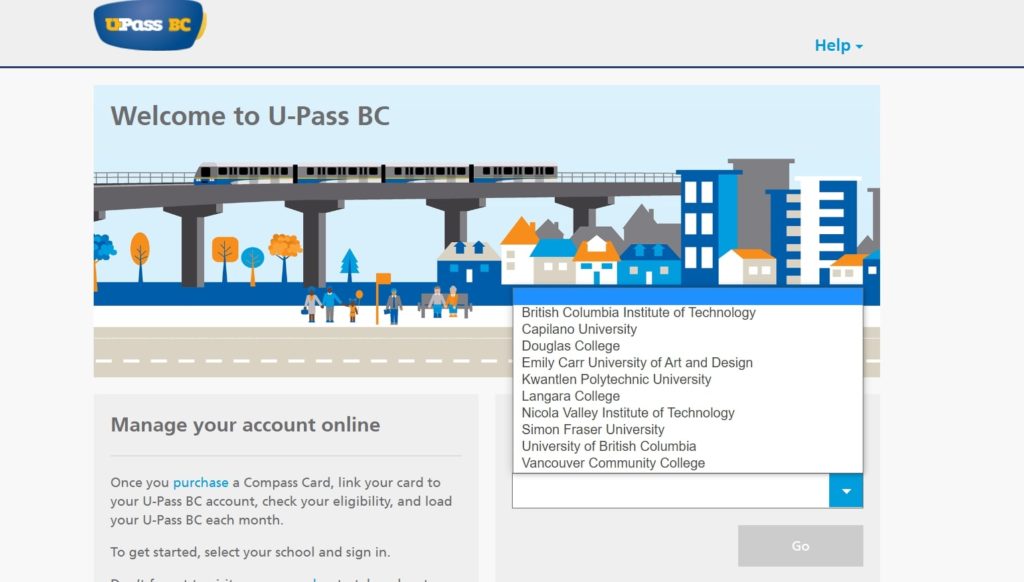

5. Transportation

Let’s say you landed an apartment that’s a bit far from your uni so you would need to rely on public transportation to get to your classes.

Lucky for us, Vancouver has a good public transit system, some of which are more affordable and efficient than others.

But since you’re a student, it’s highly likely that your university will provide you with a U-Pass BC card. This card gives you access to buses, the Skytrain, and Seabus, as well as discounts on West Coast Express! Pretty neat, right?

So you’re probably wondering, is this card free of charge? Well, not exactly. Truth is, the U-Pass BC card is included in your student fees. It’s around CAD 42.50 to CAD 45.10 if we’re not mistaken.

But by having every student contribute to the program, prices are significantly lower than regular public transit fares. It’s a great deal for students who rely on public transportation to get around the city!

Those eligible for this card are full-time and part-time students, and, of course, international students as well. All you gotta do is ask your institution for the U-Pass BC card, and you can enjoy unlimited access to public transit in the city.

How do I get a U-Pass in BC?

So how do you exactly get your U-Pass BC card? First, get a Compass Card. It looks something like this.

You’ll need this because we’re going to link your U-Pass BC onto it. You can get a Compass Card at any SkyTrain station or online.

Now we’ve got that sorted out, head over to Translink’s U-Pass BC website, then select your school.

You can then proceed to enter your Campus Wide Login (CWL) and password once you’re directed to your school’s U-Pass BC page.

After that, you can link your Compass Card and request your U-Pass benefit. Then voila! No actually, you have to wait for at least 24 hours for activation. Then, really voila!

Can I opt out of the U-Pass BC program?

The short answer is no. The long answer is nooooooo. The city of Vancouver requires all eligible students to participate in the U-Pass BC Card program.

This is because the program is a cost-effective and sustainable way to promote public transportation use among students and reduce traffic congestion. So no, that’s really the only answer to your question.

6. Entertainment

On average, the cost of entertainment in Vancouver amounts to CAD 215.50 per month.

We get it; sometimes students need to unwind and experience life outside of school, whether it’s watching movies, joining a gym, or attending concerts and sports events just to keep that school-life balance in check.

Or if you’re a home buddy, streaming platforms are your best friend for binge-watching your favorite TV shows and movies.

It’s important to find a good balance between schoolwork and personal interests to avoid getting burned out and keep your overall health in good shape.

Data from Moving Waldo via https://www.movingwaldo.com/

But we’ll let you in on a little secret. There’s actually a ton of cheap things to do in Vancouver! So maybe look into that first before splurging on movie tickets and concerts.

7. Health Insurance

The average cost of health insurance for international students in Vancouver is around CAD 600 to CAD 900 per year, while Canadian citizen students pay for healthcare through taxes.

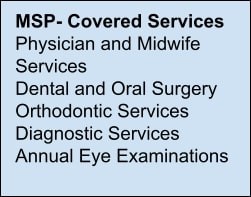

In Vancouver, residents and Canadian citizens are eligible for Medical Services Plan (MSP), which covers the cost of medically-necessary insured doctor services. For more information on the medical benefits under the MSP, check out their website.

For international students, we’re sorry to say that you would need to pay CAD 75 per month for MSP if you have a study permit valid for a period of six or more months.

We know what you’re thinking, “Can we purchase health insurance from a private company instead?”. Unfortunately, the Province of British Columbia requires this, so there’s no way around it.

So if you’re here for six months or so, it’s important to include this in your budget. For more information on how to apply, check out their website.

8. Banking

Great news! Opening a bank account and getting your own ATM is actually free! In fact, most banks even offer a cash bonus when you sign up with them. Plus, there are no monthly fees, so it doesn’t get much better than that.

Okay, so there are two types of bank accounts you can open. For international students, we highly advise you to get a checking account as this option allows you to pay for your living costs while you’re in Canada.

If you need to put money away for emergencies or a travel fund, a savings account is another option.

Here are some of the major Canadian banks that you can consider opening a bank account with and the benefits they offer.

Data from Times Higher Education via https://www.timeshighereducation.com/

Well, there you go. All you have to do is fill that up with money. Here’s another reminder to keep reading because we have a little tip at the end to help you pay your bills!

How to Open a Bank Account in Vancouver

- Call the bank or go there in person: While calling is easier, international students should open their bank accounts in person, just in case there are any problems.

- Bring two identification cards: Bring at least two (2) valid identification cards (for example, a BC driver’s license, a CareCard, and a passport).

- Proof of residency: It’s highly likely that your bank will ask for this, so make sure to bring an electricity or water bill with your name and address. It can also be an internet bill or a lease agreement if you’re renting a place.

9. Taxes

The amount of taxes you must pay is determined by your income and deductions. To put it simply, the more you earn and the fewer deductions you have, the higher your tax bill will be.

Conversely, the less you earn and the more deductions you have, the lower your tax bill will be.

For your reference, check out the Province of British Columbia’s tax brackets and rates as they change annually. Here’s an example of personal income tax brackets and rates to give you an idea.

Data from the Province of British Columbia via https://wwww.gov.bc.ca/

If you need help calculating your taxes, here’s a handy BC Income Tax Calculator that can give you the average amount you would need to pay for taxes.

Ways to Pay Your Taxes

There are multiple ways to pay for your taxes in Vancouver and it’s up to you to NOT forget to do this so maybe plot it on your calendar or write it in your personal diary.

- Online banking: with online banking, you can pay for your bills without having to visit a physical branch.

- By mail: if you’re old school, mailing a check to pay your bills is still an option, although it may take longer to process and may require additional postage fees.

- City Hall: you can pay your bills in person and have the opportunity to ask any questions or clarify any concerns you may have about your bill. However, this option may not be available 24/7 and may require you to take time off work or adjust your schedule.

- Bank or ATM: Paying your taxes through your bank or ATM is another option. However, keep in mind that your bank may require you to register a payee before accepting your tax payments.

How much does a student permit cost in Vancouver?

Here’s a section dedicated to international students out there looking to score a student permit in Vancouver. First of all, if you’re planning to study here for six months or less, you won’t need this.

But for those who are looking at one to four year programs, then this is for you. Applying for a student permit in Canada costs CAD 150.

Data from the Government of Canada via https://www.cic.gc.ca/

How to Get a Student Permit in Vancouver

- Check if you need a student permit: Visit the Canadian government’s Immigration, Refugees, and Citizenship Canada (IRCC) website to determine if you need a permit to study in Canada.

- Get the right documents: to apply for a study permit, you will need proof of acceptance, identification, financial support, and other documents.

- Sign up for an online account: sign up for an online account with the IRCC.

- Complete the application: Fill out the online application form.

- Pay the fee: The fee for a study permit application is currently CAD 150.

- Submit the application: Once you’ve filled out the application and paid the fee, submit it online.

- Waiting game: The processing time for a study permit can vary, so check the IRCC website for the most up-to-date information.

- Go to Canada: If your application is approved, you will receive a Letter of Introduction. This letter gives you permission to go to Canada, where you’ll get your real study permit at the border.

Student Jobs in Vancouver

Didn’t we promise we’d have a little something for you to help pay the bills? Well, no one said it wouldn’t require actual work so here ya go.

These are just some of the most popular jobs you can get as a student. It’s a win-win situation for those who want to earn money while building their resumes.

Data from Instarem via https://www.instarem.com/blog/top-part-time-jobs-for-students-in-canada/

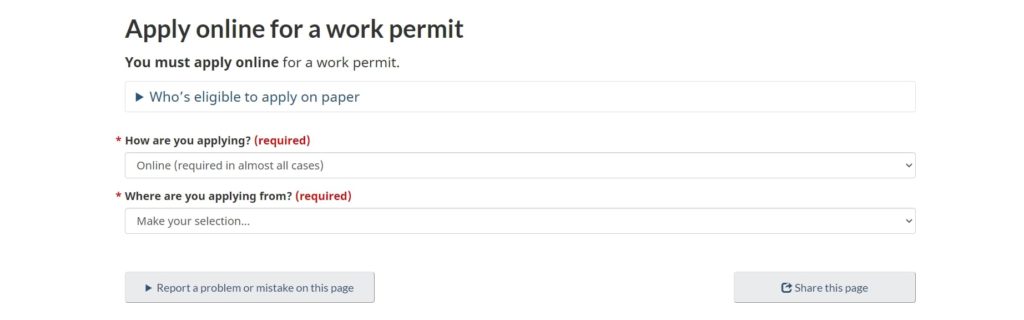

Do you need a permit to work as a student in Canada?

Getting a work permit can allow you to work up to 20 hours per week during regular academic sessions and full-time during scheduled breaks, such as winter or summer holidays.

So how do you exactly get one? Well it’s fairly easy really. First, scan and create electronic copies of your documents such as passport, study permit, and social insurance number.

Now, go to the Government of Canada’s website, sign-in, and scroll down to the “Start your application” section on the account welcome page. Then, click on “Apply to come to Canada”.

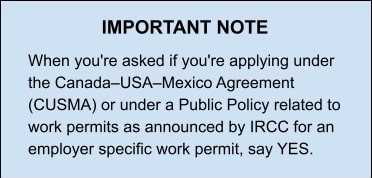

You will then be redirected to the next page. Scroll down to the “I do not have a personal reference code” section and click on the “Visitor visa, study and/or work permit” button.

From here, you’ll be asked a couple of questions like how long you’re planning to work here, your immigration status.

Finally, it takes a few weeks or months to get your work permit, so we highly advise you to get it as early as you can. Alternatively, you can check the IRCC website for the most up-to-date processing times and information.

To find out if you need a work permit, head to the Government of Canada’s website.

I think at this point, we can all agree that getting an education is expensive. But you know what? It’s also worth the investment in the long run.

With a good education, you can increase your earning potential and have more opportunities for career advancement.

Here are a few articles about the best institutions in the city that you can consider: