Tips for Families Living in Vancouver

Vancouver is a beautiful and bustling city, but it can be an expensive city to live in, especially for families. The cost of living has been rising recently, and it doesn’t seem to be slowing down anytime soon.

If you’re looking to cut back on your expenses, we’ve got some tips and suggestions to help get the most out of your finances.

1. Tips for Buying a House

Image by the City of Vancouver via https://vancouver.ca/

Vancouver is known for its beautiful scenery and scenic towns, but it also has some of the most expensive housing costs and rents in Canada. It will definitely be one of your most significant expenses.

So, if you’re planning to buy a property in Vancouver:

Explore Different Neighborhoods

Image by the City of Vancouver via https://vancouver.ca/

It’s recommended that you do your research on the best neighborhoods in Vancouver to get to know each of them thoroughly.

You’d want to live in a neighborhood that’s close to good schools, hospitals, grocery stores, and public transportation. It’s also a good idea to look into the various recreational spaces that are available, such as parks, basketball courts, swim clubs, and so on.

The best neighborhoods in Vancouver to live in, according to the 2020 Liveability Report, are Downtown, Strathcona, Fairview, Grandview-Woodland, and Mount Pleasant.

This is because these neighborhoods are close to public transportation, green spaces, and social hotspots like restaurants, bars, and shopping malls.

Check out the table below to see the different properties in Vancouver’s neighborhoods and their average cost:

Data from Moving Waldo, Area Vibes and Rent Cafe via https://www.movingwaldo.com/ and https://www.zumper.com/

Build Your Credit Score

Image by Freepik via https://www.freepik.com/

If you want to get a mortgage to buy a house in Vancouver, your credit score is important because the higher it is, the better the terms you’ll get. Mortgage lenders and banks consider your credit score when determining which loan you qualify for.

One of the wisest ways to build credit in Canada is to obtain a Secured Credit Card which is available in many banks in Vancouver. This requires an upfront payment and serves as your credit limit.

We’ve listed some options for you to consider in the table below. We’ve noted down banks in Vancouver that offer a Secured Credit Card and their costs and interest rates:

Look into Mortgage Options

Image by https://www.istockphoto.com/

Mortgages, which provide low-interest loans, are an important part of the home-buying process.

While we think it’s best to speak with a mortgage broker about your loan options, you can also consider hiring a mortgage company. What we like about the latter is that it can also handle your taxes and mortgage renewal.

Find a Good Deal

Image by Pexels via https://www.pexels.com/

To get yourself a good deal on a property, it’s best to hire a real estate agent and ask them a few questions such as

- How long has this property been on the market?

- How much have similar homes sold for?

- What’s the overall condition of the home?

These questions will reassure you of the home’s value and condition and will help you negotiate a better deal. While it may be difficult to identify issues with a simple viewing, you can also hire a home inspection company to make sure.

Make a Downpayment

Image by Dreamstime via https://www.dreamstime.com/

A deposit is the best way to secure a property that you intend to buy. In BC, a minimum down payment of 5% of the purchase price is required.

If you’re strapped for cash and need to borrow money for a down payment, you might want to consider taking out a personal loan. This can help you get started on securing a home.

Get Home Insurance

Image by Unsplash via https://unsplash.com/

Getting home insurance guarantees that your house is covered in the event of an emergency, and it’s also a requirement if you’re applying for a mortgage.

You should think about purchasing a complete home insurance policy that protects your house not only from physical damage but also from loss from theft and burglary.

Several factors affect how much you pay for home insurance. The value of your home is one factor. The location of your home is another.

If you live in a high-crime area, you will pay more for insurance than in a low-crime area. The age and type of your home also affect your rates.

Older homes and homes made of wood frame construction cost more to insure than newer homes and homes made of brick or concrete construction.

The amount of coverage you purchase also affects your rates. Lastly, the insurer you choose also has an impact on your rates. Some insurers are simply cheaper than others.

Data from Moving Waldo via https://www.movingwaldo.com/moving-tips/cost-of-living-vancouver/

2. How to Save on Food and Groceries

Image by UBC via https://food.ubc.ca/

Vancouver is an expensive city, and food is no exception. A family of four can expect to spend around CAD 110 per week on groceries, which is around CAD 6,000 per year. This does not include eating out or other food-related expenses.

With Vancouver’s high cost of living, it’s essential to be smart about your grocery budget.

Shop at Discount Grocery Stores

Image by Kitsilano via https://www.kitsilano.ca/

Several discount grocery stores in Vancouver offer significant savings on food. Examples include No Frills, Marketplace IGA, Safeway, and Save-On-Foods.

In the table below, we’ve listed down some of the most common grocery items and their average estimated cost per grocery store. Prices are indicated in CAD:

Data collected on websites of aforementioned grocery stores

Take Advantage of Coupons and Deals

Image by Reader’s Digest via https://www.rd.com/

Check the flyers for local grocery stores to find coupons and deals on items you regularly buy. You can also sign up for loyalty programs at your favorite stores to access exclusive deals and discounts.

Most Vancouver grocery stores have price-matching policies, allowing you to get better deals on items. You can also look into their weekly features, collector cards, and rewards programs, among other things.

- Marketplace IGA – Marketplace IGA has weekly flyer features where you can purchase specific items that are on sale. You can also get an AIR MILES Collector card where you earn Reward Miles when you shop with them.

- No Frills – No Frills allows you to earn redeemable points when you purchase with a PC Optimum card. They also have weekly flyer features to score good deals.

- Safeway – Now, Safeway doesn’t price match like the others but they do have weekly flyer features where they showcase discounted items. This store also allows you to earn Reward Miles by purchasing with the AIR MILES Collector card.

- Save on Foods – Save On Foods releases weekly flyers every Wednesday and the products they usually have on sale include produce, meat, and snacks. You can also earn points by purchasing with the More Rewards card.

Buy in Bulk

Image by Flickr via https://www.flickr.com/

Buying in bulk can save you a lot of money in the long run. If you have the storage space, stock up on non-perishable items like canned goods, dry pasta, and rice when they’re on sale.

Make a Meal Plan

Image by UBC via https://food.ubc.ca/

Planning your meals ahead can help you stay within your budget and avoid buying unnecessarily expensive ingredients or prepared foods. You can also consider buying meal kits from reputable companies such as EveryPlate and Dinnerly as they have the most affordable meal kits, with most plans costing less than CAD 6.

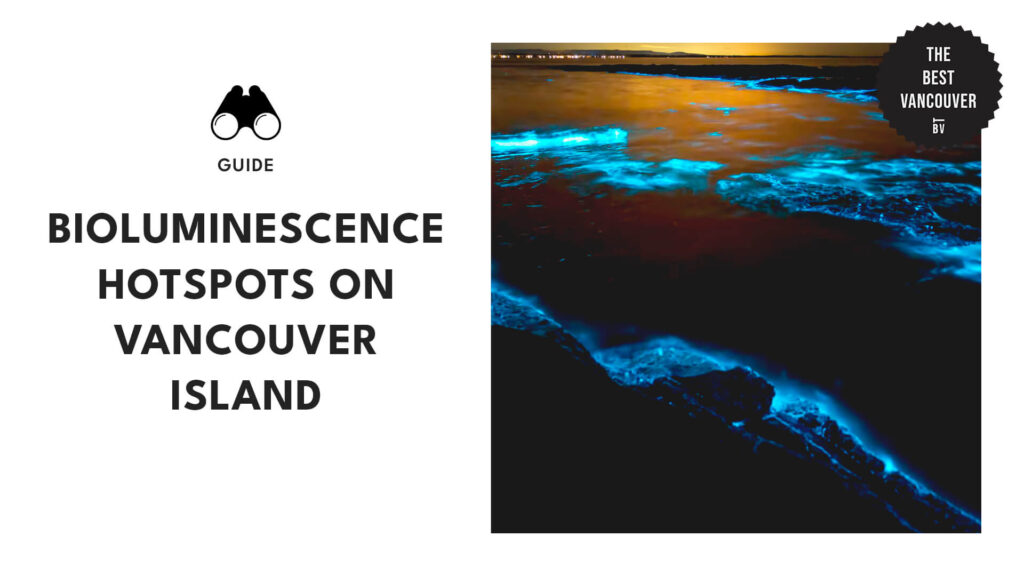

EveryPlate

Dinnerly

3. Tips on Getting Kids a Good Education

Image by UBC via https://you.ubc.ca/

It’s important to get your children into a good school once you’re all settled in. In British Columbia, there are four levels of education: pre-elementary, primary school, secondary school, and post-secondary education.

There are a few things to consider when finding a school for your child. Here are a few:

Check out School Rankings

Image by Heritage Canada via https://archive.nationaltrustcanada.ca/

The ranking of a school is one factor in determining whether or not it’s a good place for your children to learn. It’s also a good idea to think about the tuition fees that will work with your budget.

Check out the table below to see the best schools in the city, their ranking, and their average tuition fee rates:

Data from UBC Homes via https://www.ubchomes.ca

Look Into School Programs

The City of Vancouver provides an education assistance program for students to assist them with the transition to new schools.

The Guide to Highschool is a free after-school program that provides assistance to students transitioning to high school by discussing relevant topics such as stress, making friends, peer pressure, bullying, and many more.

To register, you may check out this link.

Explore Funding Options

Image by the City of Vancouver via https://vancouver.ca/

If you’re looking to get some funding for your child’s education, British Columbia grants educational funding such as grants and scholarships, and student loans.

These initiatives offer financial assistance to low- and middle-income students. As long as you’re enrolled as a full-time student in an undergraduate degree, diploma, or certificate program, they can assist with the cost of post-secondary education.

You must enroll in an approved program at a recognized institution in order to be eligible for student aid. To find out if the institution you intend to attend is designated, check out this link.

4. How to Save on Transportation

Image by the City of Vancouver via https://vancouver.ca/

According to the 2016 Census, the average Vancouver household spends about CAD 1,500 per year on transportation costs. This includes things like gas, public transit, and car maintenance. If you have a family of four, that number can quickly add up!

There are a few ways to help offset these costs. If you live close to your work or school, consider walking or biking instead of driving.

Consider Carpooling

Image by Translink via https://www.translink.ca/

Carpooling is also a great way to save money on gas. To find a carpool service in Vancouver, it’s best to join a car-sharing organization such as Evo Car Share, Modo, and Poparide.

Traveling in a single vehicle is not only environmentally friendly, but it also cuts costs in half. According to the Canadian Automobile Association, the average car costs more than CAD 10,000 per year to own. Carsharing costs an average of CAD 1,500.

If you commute more than 12 miles and plan to carpool 250 days per year, a two-person carpool will save you more than CAD 1,500!

Take Public Transit

Image by Flickr via https://www.flickr.com/

If you take public transit often, sign up for a monthly pass such as the Compass card.

This pass provides unlimited access on the SkyTrain and SeaBus, and you can get them at Compass Vending Machines, the TransLink Customer Service Centre at Waterfront Station, or online.

In the table below, we’ve listed some of Vancouver’s most common types of transportation and their average estimated cost.

Data from Numbeo via https://www.numbeo.com/cost-of-living/in/Vancouver

5. Tips on Saving on Utilities

Image by West Vancouver via https://westvancouver.ca/

The average family spends about CAD 2,500 per year on utilities in Vancouver. This includes electricity, gas, water, and internet bill. This number can be even higher for families with more than two children.

So how can you save money on utilities? Here are some useful tips:

Make Sure Your Home Is Well-Insulated

Image by BBC via https://www.bbc.com/

With a well-insulated home, you can use less energy to keep your home warm or cold. This also keeps allergens out of your home and reduces carbon emissions.

Insulation boards installed in your walls are one way to accomplish this.

Image by Industry Today via https://industrytoday.com/

These boards are made of sheets of lightly compressed vegetable pulp that has a thermal insulating effect and is moisture resistant. Insulation boards are installed on your walls with acrylic sealant adhesive or low expanding PU foam adhesive.

Board insulation costs about CAD 1 to CAD 3 per square foot on average, depending on the type of board and thickness. Check out the table below to for the most common types of insulation board and their average estimated cost:

Data from Home Advisor via https://www.homeadvisor.com/cost/insulation/

Conserve Water

Image by Unsplash via https://unsplash.com/

You can also conserve water by taking shorter showers and fixing any leaks in your home.

Another great option for conserving water is to install a tankless water heater.

Image by Plumbing and Mechanical via https://www.pmmag.com/

These units heat water on demand, so you don’t have to waste any water waiting for it to heat up. They’re also much more efficient than traditional water heaters, so you’ll save money on your energy bills as well.

Another way to do this is to switch to energy-efficient appliances as these appliances use less water such as low-flow toilets, showerheads, and faucets.

Switch to Energy-Efficient Appliances

Image by Unsplash via https://unsplash.com/

Appliances are one of the biggest energy users in your home. In fact, they account for about 20% of your home’s energy usage.

So, if you’re looking to save on your energy bill, one of the best places to start is by switching to energy-efficient appliances.

There are a few different ways you can tell if an appliance is energy-efficient. One way is to look for its energy label as this tells you how much energy it uses.

Image by Government of Canada via https://www.nrcan.gc.ca/

Another way to tell if an appliance is energy-efficient is to check its power usage rating, which is usually displayed in watts (W) or kilowatts (kW). The lower the rating, the less electricity the appliance uses.

If you’re in the market for new appliances, look for models that have high Energy Efficiency Ratings (EERs). EERs are a measure of how efficiently an appliance uses energy and are typically displayed as a number between 1 and 10. The higher the EER, the more efficient the appliance.

Pick an Internet Plan

Image by Pexels via https://www.pexels.com/search/internet/

A stable internet connection is probably a necessity in any home as we move towards the digital age. There are a lot of things to consider when you’re choosing an internet plan. The first step is to determine what you need the internet for.

Do you need it for light web browsing and email, or do you need it for gaming, streaming, and downloading? The next step is to find an internet provider in your area. Once you’ve found a few providers, compare their prices and speeds.

In the table below, we’ve listed down some of the most popular internet providers in Vancouver and their internet plan rates:

FAQs about Living in Vancouver as a Family

We know that moving to a new city is difficult. The road to success takes time and patience. We hope that our article will make the transition easier for you and help you maximize your Vancouver experience.

Here are a few related articles that we believe can be useful for you: